Capital Dynamics Wins ‘Infrastructure Manager of the Year’ at the European Pensions Awards 2025

Responsible Investment

Our commitment to Environmental, Social, and Governance

Our Commitment

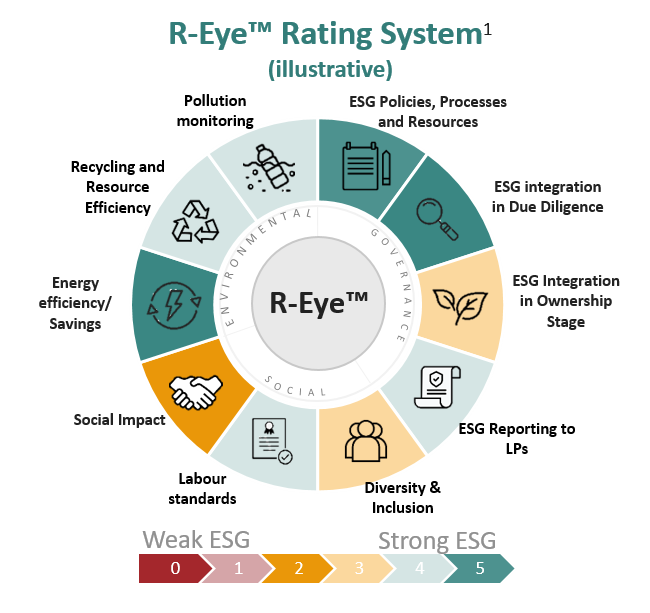

Capital Dynamics has a long-standing commitment to corporate responsibility; it is deep-rooted in the firm's DNA. In recognition of the importance of Responsible Investment, each of the firm's business lines (Private Equity and Clean Energy) integrates the United Nations-supported Principles for Responsible Investment ("PRI"), the United Nations Sustainable Development Goals ("SDGs") and other Responsible Investment factors throughout the investment appraisal, due diligence, decision-making and post-investment monitoring process. Moreover, the firm's proprietary R-Eye™ Rating System has furthered the level of transparency offered to clients.

It is core to our fundamental belief that strong Responsible Investment practices enhance long-term value creation for our clients. Capital Dynamics defines Responsible Investment evaluation as a process of the identification of potentially material sustainability opportunities and/or risks that could positively or negatively affect an investment made by any business line of our private assets platform.

Our Approach

We believe Responsible Investment leads to enhanced long-term financial returns and a closer alignment of objectives among investors, stakeholders, and society at large.

We believe the benefits of Responsible Investment include:

• Risk Reduction

• Cost Reduction

• Positive impact on operating performance

We integrate Responsible Investment practices across our organization. In addition to being an early signatory of the Principles for Responsible Investment (‘PRI’) in 2008, our company is actively engaged in initiatives to improve responsible investment industry standards.

In 2024, Capital Dynamics was awarded top scores in all investment strategies and modules*:

• Private Equity: 5 Stars (100 points)

• Confidence Building Measures: 5 Stars (100 points)

• Clean Energy: 5 Stars (99 points)

• Policy, Governance, Strategy: 5 Stars (93 points)

*The third-party ratings shown were received by Capital Dynamics in the year indicated, based on activities undertaken in the prior calendar year. Capital Dynamics did not provide any direct compensation in connection with obtaining such third-party ratings, although in certain cases we have paid a fee to become members of an organization, which membership is a precondition to obtaining a rating,or have paid a fee in order to use the issuing organization’s logo in our marketing materials.

Our proprietary investment rating system: R-EYE™

Based on the 17 Sustainable Development Goals (“SDGs”) identified by the UN, we created the R-Eye™ rating system in 2018, and deployed it across our business lines the following year. The proprietary rating system makes use of ten to twelve Responsible Investment criteria*, depending on the investment strategy, which are included in a scorecard and the Responsible Investment evaluation process. By scoring a potential investment against these criteria, we can make an informed decision whether to proceed with the due diligence or refer it to our Responsible Investment Committee for further review prior to the final investment decision. After an investment is made, this R-Eye™ rating is actively monitored and updated during the holding period of an investment. Any change in the rating is reported to our investors and protocols are in place to respond quickly and thoughtfully where any material Responsible Investment issues are identified.

[1]Capital Dynamics – in-house illustration. The R-Eye™ scorecard for each strategy will vary. Only investments beginning in 2019 are evaluated based on the R-Eye™ framework. Specific investment processes may vary depending on investment vehicle and asset class.

*For a detailed breakdown of the Responsible Investment criteria used for each business line, please refer to our Responsible Investment policy here.

Responsible Investment Committee

Our Responsible Investment Committee includes representation from each investment strategy, investment risk functions, and senior client and business professionals.

The Committee works closely with each investment team as well as the organization as a whole to make sure our Responsible Investment philosophy runs through our entire business.

The Committee:

• Approves items such as Responsible Investment policy and UN PRI submissions

• Advises Investment Committees on Responsible Investment best practice

• Evaluated potential Responsible Investment alerts within our investment portfolios

• Sets the agenda for Responsible Investment training, community involvement and the advancement of Responsible Investment thought leadership

EU Sustainable Finance Disclosure Regulation

The Sustainable Finance Disclosure Regulation (“SFDR”) applied from 10 March 2021. The SFDR requires financial market participants such as Capital Dynamics to provide information to investors with regards to the integration of sustainability risks, the consideration of adverse sustainability impacts, the promotion of environmental or social characteristics, and sustainable investment.

Our policies required by the SFDR can be found at the following links:

Our disclosures required with respect to strategies with sustainable investment objectives can be found here.

Environmental benefits generated by our Clean Energy assets*

CO2 emissions equivalent to:

-

1,512,396 homes powered for one year

-

1,841,332 passenger vehicles driven for one year