SUMMARY

Academic research1 suggests that private equity co-investments can be pro-cyclical. In the light of the negative economic impact of COVID-19 and the possibility of an improved economic situation following mass vaccination, Capital Dynamics evaluates how co-investments perform over economic cycles and whether this purported procyclicality means that the next few years should be a good period in which to increase exposure to private equity co-investment funds. The research described below tests this hypothesis.

Capital Dynamics’ empirical research concludes that co-investments often display lower dispersion from the median return compared to that of other private equity investments. The dataset available to our firm shows that co-investment returns exceeded those of buyouts generally across almost all quartiles during the last two major economic cycles. Incorporating Capital Dynamics’ intelligent portfolio construction2 further reduces the dispersion3. This co-investment outperformance versus other private equity investments was greatest in post-crisis periods. Most importantly, the research shows that postcrisis co-investments have outperformed post-crisis buyouts in terms of their lower, median and upper quartile gross IRRs. This suggests that co-investments should benefit disproportionately from market procyclicality during and after crises. Our firm’s research supports the hypothesis that increasing exposure to private equity co-investment funds in anticipation of a post-COVID recovery should prove attractive.

INTRODUCTION

Private equity co-investments are opportunities to invest alongside private equity sponsors (otherwise known as general partners (“GPs”)) directly in a company being acquired by that sponsor. Coinvestments are typically passive with the sponsor managing the investment on behalf of the coinvestors. Co-investments have become particularly popular in recent years as institutional investors have sought to increase their allocations to private equity, albeit with a focus on a number of favored sponsors. Making co-investments alongside these favored sponsors can achieve this objective and returns can be attractive, not least because sponsors do not typically charge annual fees or carried interest on co-investments.

This paper examines Capital Dynamics’ empirical research of the performance of private equity co-investments over recent economic cycles, comparing the performance of co-investments to the performance of private equity buyout transactions more generally over those same economic cycles. In 2015 Cambridge Associates estimated that coinvestments accounted for 5% of private equity activity4. Today, that number is probably closer to 15%5 and growing.

DATASET

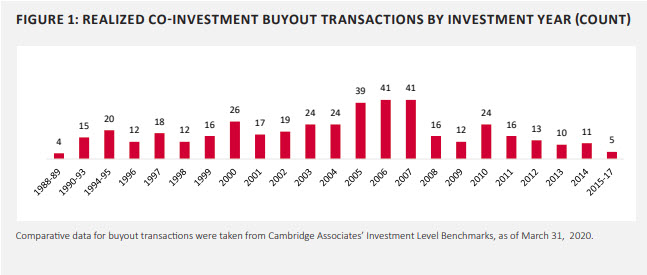

In order to undertake this research, Capital Dynamics constructed a dataset of 435 wholly realized coinvestment buyout transactions made between 1988 and 2017. This period includes the recession that followed the dotcom bubble of 1998 to 2000 and the great financial crisis (“GFC”). The information was supplied to Capital Dynamics by private equity sponsors when Capital Dynamics was undertaking primary fund due diligence on those sponsors and included data from GPs where the firm did not ultimately proceed to make a fund commitment.

Whilst earlier academic research6,7, has included unrealized and venture co-investments, Capital Dynamics’ analysis was confined to wholly realized buyout transactions, including those written off. The data cover co-investments in transactions led by 35 discrete sponsors in Europe (53% of deals), the US (44%) and Asia (3%). Of the 435 transactions, 91 (21%) were concluded in 2009 or later, after the GFC, as shown in Figure 1 below.